Japanese tech group SoftBank has acquired yet another British chip player. This time it has snapped up Bristol-based AI processor developer Graphcore, whose very survival was in doubt over the past year.

The acquisition comes as investors compete to back the next big thing in AI. Moreover, larger tech companies who feel that their own in-house AI capabilities are falling short have been searching high and low for acquisitions that can mitigate these inadequacies and give them a leg up on the competition. And it would seem they are increasingly looking to Europe for potential targets.

Just this week, the news broke that US chip giant AMD would purchase Finnish artificial intelligence company Silo AI for $665mn in a bid to take on Nvidia. Today’s Graphcore acquisition announcement constitutes SoftBanks’s latest push to keep up with the global AI stampede. The exact value of the deal remains undisclosed.

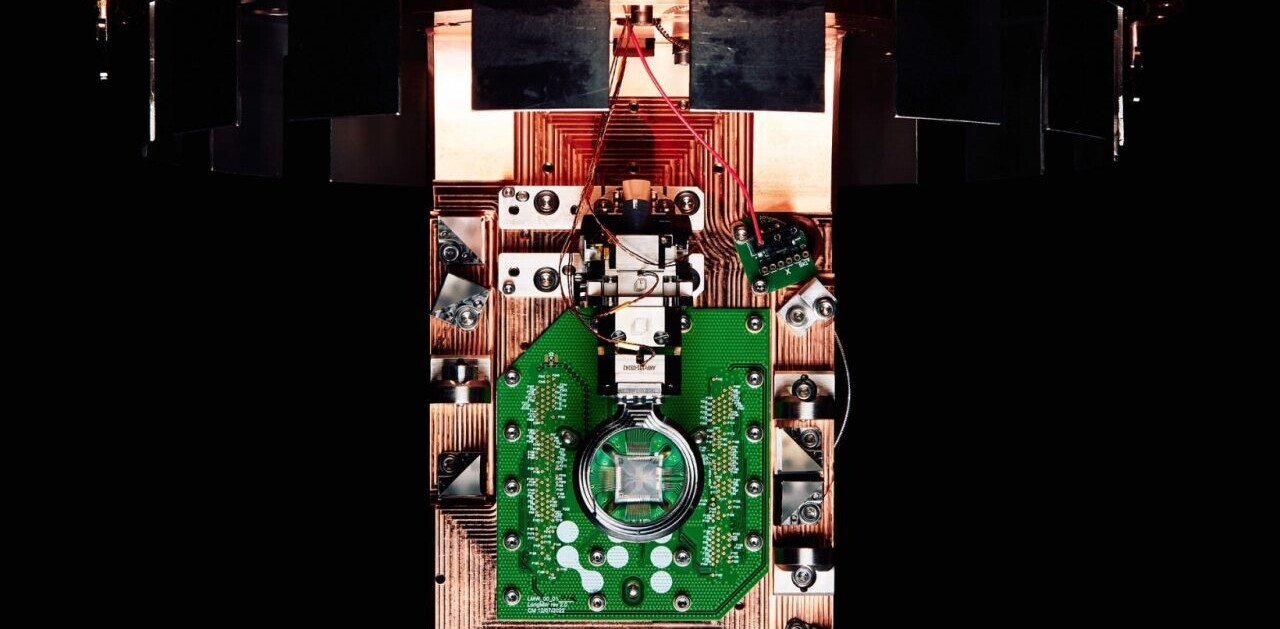

Intelligence processing units

Graphcore builds “intelligence processing units,” or IPUs. The company has designed the processors from the get-go to optimise machine learning and AI workloads. They have a massively parallel architecture which significantly enhances AI performance compared to CPUs and even GPUs.

The company’s second-generation Colossus MK2 GC200 chip is marketed as the “world’s most advanced processor” and a competitor to Nvidia products. So at first glance, it would seem SoftBank has made a good deal.

However, Graphcore has thus far failed to capitalise on the AI frenzy of the past couple of years. As late as October 2023, the company warned it would need to raise funds by May 2024 to continue operations. While the SoftBank acquisition puts an end to its immediate woes, it remains to be seen if Graphcore will succeed in monetising its technology.

Hit or miss?

While SoftBank and its record-breaking Vision Fund have made several ill-advised investments (such as WeWork, or robot-crafted pizza-making service Zume), there have also been triumphs.

In 2016, the group purchased British chip designer Arm for $32bn, and subsequently took it public last year while retaining approximately 90% of the company. Much due to the IPO success of Arm, SoftBank shares rose to an all-time high of 11,190.00 Japanese yen ($70.33) on Thursday July 4.

SoftBank has previously said it is ready to pour close to $9bn per year into AI investments. When it comes to Graphcore, perhaps Masayoshi Son, SoftBank’s CEO, is hoping that betting on Britain and its chips again will end up yielding similar results. Let’s see if by this time next year the next rush will be for IPUs, but Jensen Huang is probably not too concerned just yet.

Get the TNW newsletter

Get the most important tech news in your inbox each week.